One of the frustrating things about having a severe or life-threatening illness is that it can in one fell swoop annihilate all the goodwill you’ve earned from a lifetime of good decision making.

And it’s not just your health that’s impacted. It’s finances as well, as I’ve been writing about. One place it can have a tremendous impact is on your credit report.

Credit is a rather fickle thing. I opted to destroy mine by living in France for a year, back when computers weren’t so prolific and it would take overseas bills months to show up on my credit statement. After that, I laid low, spending only what I could afford and keeping only one credit card open. After a few years, I decided to apply for a car loan, only to find that my credit had repaired itself over time. A few years after that, I found myself nearing 800 – which is an A+ rating – when I went to apply for a mortgage.

And then, something strange happened. Several bills went astray, leading to late payment notifications on my credit report, which penalized me harshly. When my score fell dramatically, I started to pay close attention to how my credit score was calculated and what I could do to improve it. I wrote letters to creditors, then the credit reporting agencies. I was able to get a few of the bad marks removed, but not all of them. Again, time was the great healer.

During that time, Congress passed the HIPAA privacy act which I learned prevented creditors from reporting medical debt, as it violated privacy laws. About that time, some obscure bill showed up on my credit report (which I don’t think was mine) claiming I owed a doctor $35. I cited the act in a letter to the credit reporting agency and had it removed.

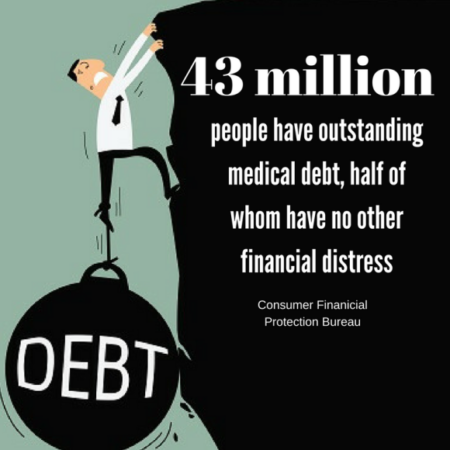

Despite that little known loophole, a recent study by the Consumer Financial Protection Bureau found that medical expenses comprise more than half of debt on credit reports and roughly 21 million people with medical debt (which account for nearly half) showed no other signs of financial distress – meaning that up until being diagnosed with something, they’d been making really good choices.

And yet, despite those good choices, in 2013, nearly 2 million people filed for bankruptcy because of medical debt. It was the No. 1 reason for filing, despite many of them having health insurance, according to NerdWallet Health.

The CFPB found that confusing medical bills caused the biggest headache for consumers, leading to credit reporting problems. Specifically, the authors said that it often is difficult to tell from insurance and hospital statements how much is owed, the payment deadlines, and which organization to pay.

Tell me about it. I get a bill from the hospital, another from a doctor that shows she’s discounting a portion of the hospital bill and none of the figures of either bill seem to correspond to what shows up on my health insurance statement. Nor do the amounts owed or paid.

My friend Joan Redding of the Credit Counseling Center – whom I’ll talk about tomorrow – offers some good advice, including negotiating with the hospital before it goes to a collections company, which is where credit problems begin.

That’s where I’m at, at the moment, working with my medical providers to find a solution and doing my best to stay away from tapping my retirement funds.

And I’m hoping a pattern of good decisions will pay off in the end.